What Is Financial Data?

Financial data plays a critical role in all business decision-making as it provides quantitative information that helps to provide a clear view of the financial health of an organization. This vital information is gathered from traditional sources, such as public documents and external data sources, which are considered alternatives. It can be historical or current and collected on an ongoing, periodic (e.g., quarterly, annually), or as-needed basis (e.g., related to a transaction).

Investors, creditors, managers, and regulators endlessly analyze financial data. Still, across these users, financial data is used to measure different types of performance—from an investment perspective or against strategic objectives. Because it is so integral to business, the fidelity of financial data is of the utmost importance. Financial data quality is based on its:

- Accuracy—to be relied upon for confidently making decisions.

- Completeness—to provide a comprehensive view of an organization’s financial well-being.

- Timeliness—to support fast decision-making.

In addition to reflecting an organization’s health, financial data can be used to identify trends and assess risks. Financial data is also used to benchmark an organization’s performance against competitors and an overall market.

Financial Data Types and Uses

Financial data is categorized into two broad types—traditional financial data and alternative data.

Traditional financial data

Traditional financial data refers to information from long-established sources, such as financial statements, press releases, and SEC filings. These include financial data related to an organization’s assets and liabilities. Financial information about assets consists of the organization’s real, personal, tangible, and intangible property. Liabilities cover the financial data related to an organization’s financial obligations or debts. Financial data related to equity covers what would be left over if liabilities were covered and assets were liquidated.

Alternative financial data

Alternative financial data is external data that an organization does not directly report. It is usually gathered in three ways:

1. Acquiring it from raw data sources (e.g., sensors, instrument readings)

2. Licensing third-party data

3. Web scraping

Examples of alternative financial data include:

- Credit card transactions

- Crowdsourcing

- Email receipts

- Financial transactions

- Geolocation data

- Jet tracking

- Mobile app usage

- Point-of-sale transactions

- Price trackers

- Product reviews

- Public records

- Satellite images

- Shipping container receipts

- Shipping trackers

- Social media posts

- Web browsing activity

- Website usage

Uses for financial data

Financial data is analyzed to provide actionable insights. It involves thoroughly examining an organization’s financial data using internal or external teams to assess past trends and guide future decisions. This financial data analysis is performed using several techniques.

Fundamental financial data analysis

This involves using ratios from the organization’s financial data and a wide range of factors to assess its value. Some examples of financial ratios are liquidity ratios, solvency ratios, profitability ratios, efficiency ratios, and coverage ratios.

Horizontal financial data analysis

This technique involves comparing historical financial data over two or more years to detect growth trends.

Technical financial data analysis

This uses statistical trends collected from the trading activity of the company’s stock to identify patterns and trends that can help predict future activity.

Vertical financial data analysis

This method looks at how items on a financial statement compare.

What Is an Example of Financial Data?

Financial statements are documents that contain financial data about an organization over a time period (e.g., annually, quarterly). This financial data is considered highly credible, because finance teams, accounting firms, and government agencies audit it. Acting as a financial health report, this financial data provides insights into an organization’s past, current, and projected performance.

Examples of financial statements include the balance sheet, cash flow statement, and income statement. This financial data is used to calculate the important financial ratios noted above. Each financial data set provides unique details with interconnected information that gives a comprehensive view of an organization’s operating activities.

Balance sheet

A balance sheet contains an overview of a business’s assets, liabilities, and equity at a given time. Sometimes called the statement of financial position, a balance sheet provides information on an organization’s worth with details about assets, liabilities, and shareholders’ equity. To “balance,” the financial data in a balance sheet must have assets equal to liabilities plus equity. It provides a quick measure of an organization’s balance, including asset turnover, the quick ratio, receivables turnover, days to sales, debt to assets, and debt to equity.

Cash flow statement

The cash flow statement estimates an organization’s ability to generate cash to cover its liabilities and fund operating expenses. This bit of financial data provides a summary of how money flows through an organization. A cash flow statement shows overall liquidity by reporting on all cash inflows and outflows over a given period along with the total cash available. There are three parts of a standard cash flow statement, with the net increase and decrease in cash flow noted in each area.

1. Operating—cash received and expenses paid

2. Investing—asset purchases and gains from invested assets

3. Financing—proceeds from deb and stock issuance and cash payments for obligations (e.g., interest, dividends)

Income statement

Income statements also referred to as profit and loss (P&L) statements, give an overview of sales, expenses, and the total net income for a time period. The net income value is generated income minus expenses. An income statement provides a summary of revenue and operating expenses, thereby showing the organization’s profitability.

What Is Financial Data Management?

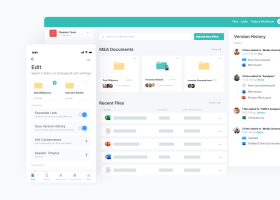

Financial data management is used by organizations to collect, track, and report on all of all their financial metrics. The function of financial data management is mostly accomplished using a set of tools and processes. These, commonly executed with the assistance of software applications and financial data management solutions, provide specialized tools that help organizations present, measure, and analyze their financial information.

The output of financial data management allows organizations to manage and consolidate financial information, adhere to strict regulatory compliance requirements driven by accounting rules and laws, and produce financial reports with varying degrees of granularity based on the target audience.

Financial data management software offers artificial intelligence (AI) and machine learning (ML) driven predictive modeling and other business intelligence for strategic planning and forecasting. This enriched data help inform long-term strategies and optimally manage resources to reduce costs, optimize operations, and gain a competitive advantage.

Protecting the Fidelity of Financial Data Is Critical

Financial data is an invaluable resource for most stakeholders in an organization—internal and external. It provides a view into performance in terms of revenue and profitability and can be a bellwether for not just a single organization, but entire markets.

While the information included in financial data sets can be interpreted differently by various audiences, the raw information must be protected to ensure the integrity of downstream decisions. For this reason, regulations abound around creating, handling, and safeguarding financial data.

Egnyte has experts ready to answer your questions. For more than a decade, Egnyte has helped more than 16,000 customers with millions of customers worldwide.

Last Updated: 2nd October, 2023