We Have Big Things to Show You

The self-guided tour requires a larger screen. Please come back next time you’re on your desktop device.

We Have Big Things to Show You

The self-guided tour requires a larger screen. Please come back next time you’re on your desktop device.

We Have Big Things to Show You

The self-guided tour requires a larger screen. Please come back next time you’re on your desktop device.

Professional Association Services Empowers Staff and Delights Clients With AI-Powered Content Intelligence

Leading association management company saves valuable time and improves client service by using Egnyte Copilot to instantly find answers across 150 unique communities.

Key Benefits With Egnyte Copilot

- Instant answers to complex questions, dramatically reducing research time

- Empowered staff with a productivity tool that makes their lives easier

- Data security by delivering AI insights entirely within the trusted Egnyte platform

For nearly four decades, Professional Association Services (PAS) has provided expert management for homeowners associations (HOAs) across the San Francisco Bay Area. Managing approximately 150 unique communities created a significant operational challenge, as finding specific answers within a massive volume of documents was a slow, manual process. Seeking a competitive edge, PAS adopted Egnyte Copilot to integrate AI-powered intelligence directly into their existing, trusted platform. Copilot transformed research by allowing employees to simply ask questions and receive instant, source-verified answers, empowering the team to service clients faster and more accurately than ever before.

The Challenge: From Foundational Access to Advanced Intelligence

When PAS became an Egnyte customer in 2019, they were facing foundational business challenges. Data was housed on a file server at its main location, which made remote access difficult for employees working from home or visiting association properties. Sharing files internally across their multiple locations was difficult, and they had to rely on insecure email attachments to send critical documents to clients. To better safeguard its data from cybersecurity incidents, the company also sought robust ransomware protection. The move to Egnyte’s cloud platform solved these pressing issues of remote access, internal and external collaboration, and data security.

With all their data centralized on Egnyte, a new hurdle emerged: sifting through the immense volume of information efficiently. In the association management industry, speed and accuracy are paramount.

“Every association is unique and built differently,” said Carlos Molina, Owner and CTO, who helps run the business his wife started in the early 1990s. “When a resident calls in or a board member brings up a point of contention in a meeting, our staff has to go find the answers. In the past, that took a lot of sitting and reading documents, opening up PDF after PDF”.

This manual process was not only inefficient but also unscalable. With a background in telecommunications, Molina understood the power of technology and saw the emerging trend of AI in his industry. Competitors were beginning to offer AI solutions, but they came with a significant catch.

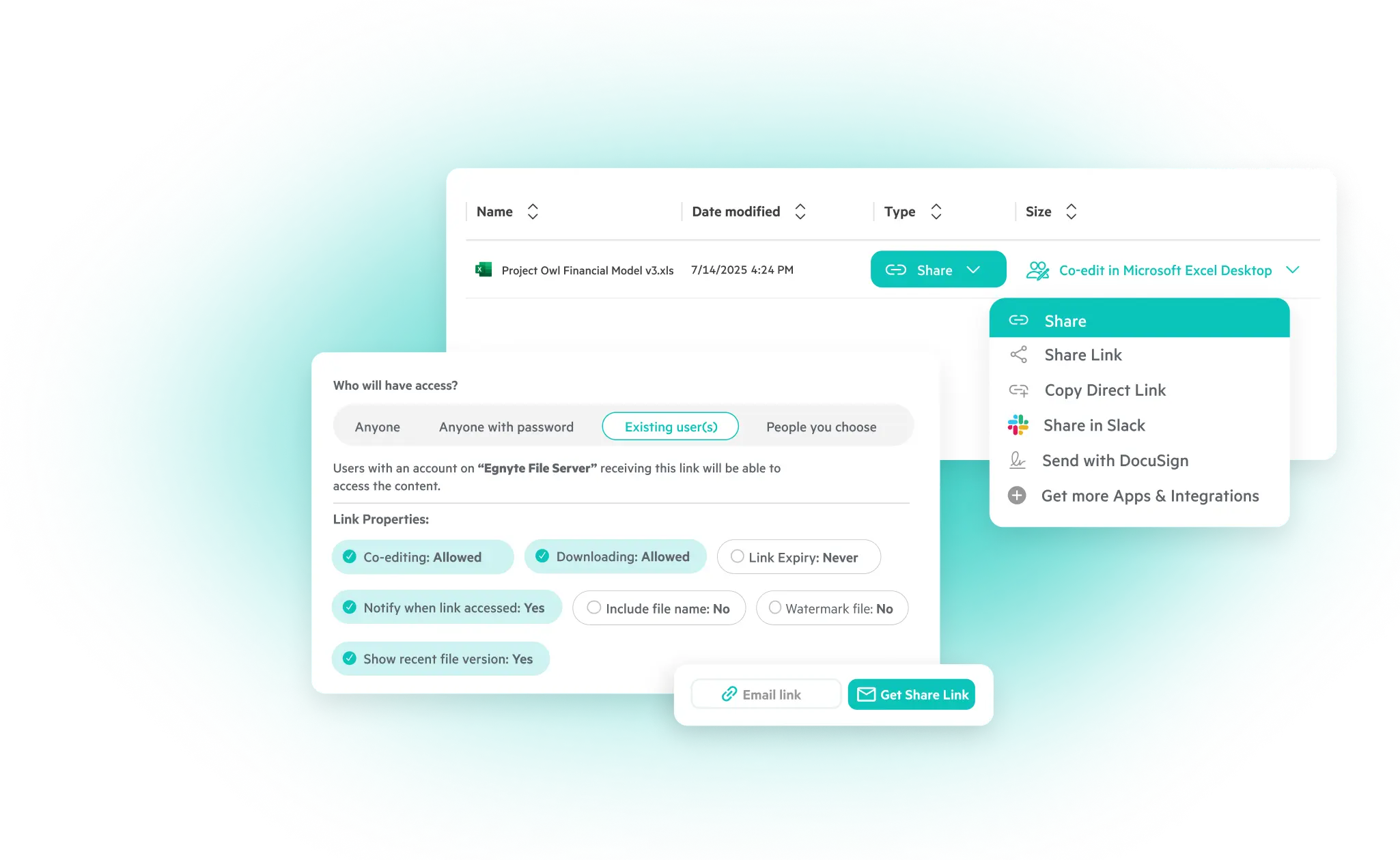

“Other AI solutions basically offer what Egnyte Copilot is offering us, but it's separate,” Molina explained, noting that adopting those tools would require loading all of PAS's documents onto a different platform. PAS was already a happy Egnyte customer. "One of the things we really like about Egnyte is the ability to send external links," he added. "If we ever make an error in a document, we don't have to send a new link; we just fix the document”. This trust, built on powerful and convenient features, made them want a solution that worked within their existing Egnyte environment.

The Solution: A Strategic First Step Into AI

When Egnyte announced Copilot, Molina knew he had found the perfect fit. It was the ideal way to introduce the power of generative AI to his team without disrupting their existing workflows or compromising data governance. Crucially, because Egnyte Copilot is secure by design, the AI comes to the content, meaning PAS’s proprietary data never leaves the security of the Egnyte platform.

“When Egnyte launched Copilot, I thought that was great. I have all my controls and I know where all my documents are,” Molina said.

The implementation was straightforward. Molina created a distinct knowledge base within Copilot for each community. This simple act instantly turned their static archives into an intelligent, interactive resource. Now, when an employee needs to know the specific rules for a satellite dish installation or the history of a landscaping decision for a particular community, they no longer have to hunt for the information manually. “They can just go to the community’s knowledge base and ask the questions. It's so much faster,” Molina noted. For PAS, Egnyte wasn't just about technology; it was an investment in its employees. “I wanted to provide tools to our employees to make their life a little easier, and show them that we’re invested in their happiness and job satisfaction,” he said.

The Results: “A Game Changer” for Employee Efficiency

The impact of Egnyte Copilot was immediate and felt across the organization. What used to be a time-consuming research project became a simple query. The feedback from the team was overwhelmingly positive.

A former Senior Community Manager with PAS experienced the benefits of Copilot in her daily use at PAS. She could find community information quickly with helpful summaries that also included the sources, ensuring that she provided factual information to her clients.

The ability to get not just an answer, but a verifiable, source-backed response, is critical for a business built on providing accurate guidance. This functionality has empowered employees in every role.

Tim Pinella, an escrow coordinator at PAS, uses it to accelerate tasks that are crucial for property transactions. “Egnyte Copilot has made me more efficient with my time when it comes to finding specific information in large document folders,” Pinella said. “For example, when needing to find the total square footage of an association, I am able to quickly search with Egnyte Copilot and it will bring up the necessary information and supporting documents. This used to take much longer in searching through the documents myself. Copilot has been a pleasant experience and useful tool for my line of work.”

For Molina, these outcomes are the realization of his strategic vision. “Egnyte Copilot helps everybody research, understand, and learn, while providing faster service to our clients,” he affirmed. By using technology to deliver superior service, PAS sharpens its competitive edge and is positioned for continued growth.