How Intelligent Document Processing Transforms Onboarding Workflows

Slow onboarding loses customers. In today’s fast-moving financial landscape, even a few extra steps can drive clients to competitors. That’s why industry leaders are turning to automated onboarding workflows powered by Intelligent Document Processing (IDP). The result? Faster client activation, airtight compliance, and operational efficiency at scale. Let’s discover how IDP is redefining business automation workflows, and why embracing it is essential.

Let’s jump in and learn:

- Key Takeaway:

- What Is Intelligent Document Processing?

- Challenges in Traditional Onboarding Workflows

- Role of Intelligent Document Processing in Onboarding

- Key Benefits of IDP in Onboarding Workflows

- Typical Use Cases of IDP in Onboarding

- Best Practices for Implementing Intelligent Document Processing

- This Is How Egnyte Can Help You

- Case Studies and Success Stories

- Frequently Asked Questions

Key Takeaway:

- IDP transforms onboarding by automating document extraction, classification, and validation, eliminating slow, error-prone manual processes.

- Financial institutions gain speed, accuracy, and compliance, reducing onboarding time by up to 70% while improving KYC/AML verification and auditability.

- Automated workflows enhance customer experience, enabling faster approvals, seamless digital journeys, and fewer resubmissions across devices.

- Successful IDP adoption requires strategic implementation, including strong security, seamless system integrations, continuous model optimization, and tools like Egnyte that provide AI-powered workflows, low-code automation, and compliant document management.

What Is Intelligent Document Processing?

Intelligent Document Processing (IDP) uses AI, machine learning, and NLP to automatically extract, classify, and validate data from documents—structured or unstructured. For financial services, it means faster, error-free handling of forms, contracts, KYC records, and loan documents, helping with automated onboarding workflows.

- Automates onboarding & KYC

- Speeds up loan and mortgage approvals

- Handles diverse formats (PDFs, scans, emails)

- Boosts compliance, accuracy & efficiency

- Feeds clean data into CRMs and analytics tools

With IDP, manual document handling is replaced by speed, scale, and smarter workflows.

Challenges in Traditional Onboarding Workflows

Before the rise of automated onboarding workflows, financial services institutions struggled with clunky, manual processes that often did more harm than good. Traditional onboarding methods are not only time-consuming, they’re also risky, error-prone, and resource-intensive.

Manual Data Entry and Errors

Paper-based forms and manual data entry remain common in legacy systems. This invites human errors, including typos, missing fields, and inconsistencies that trigger repeated verification cycles. These delays frustrate customers and can lead to non-compliance with regulatory mandates. Worse, even a minor input mistake can derail the entire onboarding process.

Time-Consuming Verification process

Traditional workflows often demand in-person visits, physical document submissions, and multi-step approvals. Verifying identity or financial history may take days or weeks. In a digital-first world, this lag increases abandonment rates, especially among younger, tech-savvy customers expecting instant service.

Compliance and Security Risks

Sensitive financial documents, such as KYC forms and account details, are frequently stored in physical formats or unencrypted systems. This makes traditional onboarding vulnerable to data breaches, loss, and unauthorized access. Manual processes also increase the likelihood of overlooking key KYC/AML checks, exposing institutions to regulatory penalties.

As expectations rise and compliance becomes stricter, the case for business workflow automation and intelligent document management for financial services institutions is clearer than ever. It’s time to leave outdated processes behind and embrace smarter, faster, and more secure onboarding powered by intelligent document workflow automation.

Role of Intelligent Document Processing in Onboarding

Automated onboarding workflows are critical to delivering efficient, accurate, and compliant customer experiences. Intelligent Document Processing (IDP) plays a pivotal role in this transformation by automating time-consuming, document-heavy tasks that have traditionally slowed down onboarding.

Automated Data Extraction and Classification

IDP uses Optical Character Recognition (OCR), Natural Language Processing (NLP), and machine learning (ML) to scan, digitize, and understand a wide range of documents, such as government IDs, utility bills, bank statements, and investment forms. It automatically classifies each document type and extracts key data fields such as name, address, and account details, removing the need for manual input and reducing onboarding times dramatically. This automated approach ensures all required data is captured consistently and routed to the right backend systems, laying the foundation for a smooth, scalable business workflow automation tool.

AI and Machine Learning Technologies Used

IDP’s intelligence lies in its layered AI capabilities:

- OCR digitizes physical and scanned documents.

- NLP interprets and extracts context from unstructured text.

- ML improves accuracy over time by learning from document variations and historical corrections.

- Deep learning enables handwriting recognition and fraud detection, improving decision-making and compliance.

These technologies work together to validate data, cross-reference it with internal and external databases, and flag anomalies in real time, strengthening both speed and security.

Enhancing Accuracy and Speed

By eliminating manual processes, IDP minimizes human errors and accelerates turnaround. Onboarding cycles that once took weeks can now be completed in hours, while maintaining compliance with KYC and AML regulations. This also leads to better audit trails, fewer reworks, and significant cost savings.

From document workflow automation to real-time verification, IDP equips financial services institutions with the tools they need to create faster, smarter onboarding journeys. It’s a cornerstone of modern document management for financial services institutions, ensuring every new client experience is accurate, compliant, and built for scale.

Key Benefits of IDP in Onboarding Workflows

IDP empowers organizations to shift from manual inefficiencies to fully automated onboarding workflows that drive speed, accuracy, and customer satisfaction.

Faster Client Onboarding

With IDP, banks and financial institutions can dramatically reduce the time it takes to onboard clients. By automatically extracting and classifying data from IDs, tax documents, financial statements, and compliance forms, IDP eliminates delays caused by manual review and data entry.

Instead of waiting for days or weeks for approvals, clients can be onboarded in hours. Some organizations report cutting onboarding time by over 70% while achieving accuracy rates above 99%. This not only accelerates customer activation but also shortens time-to-revenue.

Reduced Operational Costs

Manual onboarding processes demand significant human resources to handle repetitive tasks like document sorting, data validation, and verification. With IDP, these functions are automated through AI-powered tools such as Optical Character Recognition (OCR), Natural Language Processing (NLP), and machine learning.

The result? Fewer errors, smaller teams, and major cost savings. IDP also scales easily to accommodate spikes in onboarding volume during peak lending seasons or product launches, without the need to expand headcount.

Improved Compliance and Auditability

Compliance is non-negotiable in financial services. IDP enhances open source workflow automation by validating extracted data against KYC, AML, and other regulatory checklists. It flags inconsistencies, cross-checks identities, and ensures every document meets policy standards, greatly minimizing the risk of non-compliance.

Even better, IDP generates real-time audit trails and compliance reports, simplifying internal reviews and external audits while strengthening your document management for financial institutions.

Enhanced Customer Experience

Today’s clients expect onboarding to be digital, quick, and frictionless. IDP supports document workflow automation that ensures fewer errors, faster processing, and smoother customer journeys. Clients no longer have to resubmit forms or deal with endless back-and-forth.

With omnichannel capabilities, IDP allows customers to start the onboarding process on one device and finish on another, delivering the seamless, secure experience modern users demand.

In short, Intelligent Document Processing modernizes onboarding from end to end. It enables financial services institutions to work smarter, cut costs, reduce risks, and build lasting client relationships, all while staying compliant and competitive in a digital-first economy.

Typical Use Cases of IDP in Onboarding

Intelligent Document Processing (IDP) delivers tangible benefits across multiple touchpoints in automated onboarding workflows. It transforms how institutions handle identity verification, document validation, and data integration, key areas where efficiency, accuracy, and compliance are non-negotiable.

Identity Verification

Verifying customer identity is a foundational step in onboarding. IDP automates the extraction and validation of key data from government-issued IDs such as passports, driver’s licenses, and birth certificates. Using OCR, NLP, and AI classification, IDP converts these documents into machine-readable formats, pulls relevant fields (e.g., name, date of birth, address), and verifies them against public or internal databases. This eliminates the need for physical verification and manual data entry, enabling quicker, more accurate KYC compliance and reducing the risk of onboarding fraud.

Document Validation and Fraud Detection

Financial services rely heavily on accurate documentation, such as income proofs, credit reports, utility bills, and tax filings. IDP not only extracts data but also validates it by cross-referencing against predefined regulatory and business rules. It can flag inconsistencies, detect forged documents, identify mismatched information, and spot altered data fields. These fraud detection capabilities make IDP a critical component of document workflow automation, particularly in industries where security and compliance are paramount. Automated anomaly detection reduces manual oversight and speeds up decision-making during onboarding.

Data Integration With CRM and Backend Systems

Once documents are verified and validated, IDP ensures that clean, structured data flows seamlessly into backend systems such as CRM platforms, loan origination software, compliance databases, and customer service tools. This tight integration eliminates duplication, accelerates downstream processes, and supports end-to-end business workflow automation. For example, once onboarding is complete, IDP can automatically populate customer profiles, initiate service activation, and trigger credit risk assessments, enabling a faster and more connected onboarding experience.

Best Practices for Implementing Intelligent Document Processing

Successful implementation of Intelligent Document Processing goes beyond choosing the right technology. It requires strategic alignment with your onboarding goals, robust security protocols, and continuous optimization. These best practices ensure your automated onboarding workflows deliver lasting results in efficiency, compliance, and customer experience.

Choosing the Right IDP Solution

To maximize the value of business workflow automation, start with a clear plan:

- Identify High-Impact Use Cases: Focus on document-intensive areas like KYC verification, loan applications, and compliance documentation.

- Evaluate Core Capabilities: Look for platforms offering advanced OCR, NLP, machine learning, and deep learning for document extraction and classification.

- Ensure Seamless Integration: Your IDP tool must integrate with CRMs, compliance systems, and other backend platforms to enable true document workflow automation.

- Hybrid AI Models: Choose a platform that combines rules-based and AI-driven processing for higher accuracy in edge cases.

- Scalability: Opt for cloud-native or flexible architectures that support fluctuating volumes and evolving document formats.

- User Experience: Ensure intuitive interfaces and support for human-in-the-loop workflows to handle exceptions and train AI models effectively.

Ensuring Data Security and Privacy

Security and trust are foundational in financial services. Your IDP implementation must include:

- Strong Encryption: Encrypt sensitive data both in transit and at rest.

- Role-Based Access Control (RBAC): Limit document access to authorized users through robust authentication protocols.

- Data Redaction and Anonymization: Automatically identify and redact personally identifiable information (PII) for regulatory compliance.

- Regulatory Compliance: Verify adherence to GDPR, HIPAA, CCPA, and financial services-specific mandates.

- Audit Trails: Maintain full logs of document handling and processing for audits and traceability, which are key features in secure cloud storage solutions.

Continuous Monitoring and Process Optimization

Even after deployment, effective IDP systems require ongoing refinement:

- Retraining AI Models: Update models regularly using new data and error corrections to improve performance.

- Input Quality Checks: Enhance document clarity using pre processing techniques like image sharpening or de-skewing.

- Performance Monitoring: Track KPIs such as extraction accuracy, error rates, and processing speed.

- Human Feedback Loops: Allow manual review of flagged exceptions to refine results and catch anomalies.

- Workflow Optimization: Continually expand business automation workflows by adding triggers, rules, and document types.

- Scalability Testing: Ensure your system performs under peak load without performance or security degradation.

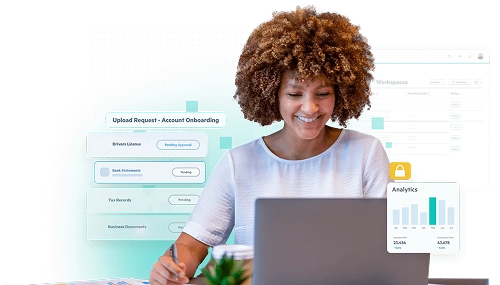

This Is How Egnyte Can Help You

Egnyte simplifies onboarding workflows through AI-driven document management and seamless integration with enterprise tools.

AI-Powered Document Workflows

Automatically extract metadata, classify documents, route files for approval, and enable secure eSignatures, without manual effort.

Low-Code Integration

Egnyte supports integration with multiple platforms, including Microsoft Power Automate, enabling you to created automated workflows triggered by file uploads, metadata updates, or approvals.

Smart Triggers and Task Automation

Configure workflows to launch automatically, assign tasks, send reminders, and escalate delays, keeping onboarding on track.

Secure, Compliant, and Auditable

Ensure data protection with encryption, access controls, and full audit trails, which are essential for financial services compliance.

API and Platform Connectivity

Connect to CRMs, Slack, Zapier, and more to build a fully integrated onboarding ecosystem.

Case Studies and Success Stories

Explore Egnyte’s real-world impact on financial services teams like yours.

- See how The Colony Group streamlines regulatory reporting with Egnyte

- Discover how The Riverside Company streamlines procedures with Egnyte

Onboarding doesn’t have to be a bottleneck. With Intelligent Document Processing, financial services teams can turn a traditionally tedious process into a streamlined, secure, and scalable experience. By combining AI-powered automation with smart integrations, IDP unlocks speed, accuracy, and compliance where it matters most.

Frequently Asked Questions

Q: How does intelligent document processing (IDP) differ from traditional document automation?

A: IDP uses AI, ML, and NLP to process structured, semi-structured, and unstructured documents, adapting to various formats and improving over time. Traditional automation relies on static templates and rules, making it less flexible, less accurate, and poorly suited to complex or variable document workflows.

Q: How does IDP handle different types of documents and data formats?

A: IDP uses advanced OCR, NLP, and machine learning to extract, classify, and validate data from diverse sources such as PDFs, emails, scanned images, even handwritten forms. It adapts to varying formats without templates, enabling accurate processing across virtually any document type with minimal manual input.

Q: How can organizations encourage staff to adopt and trust automated onboarding processes?

A: Foster trust through transparency, training, and human-in-the-loop design. Highlight efficiency gains, involve users early, address security concerns, and showcase real-world impact. Support from leadership and responsive feedback loops can further ease the transition and boost adoption across teams.

Q: How does intelligent document processing reduce onboarding times for new clients or employees?

A: IDP automates data capture, validation, and compliance checks, accelerating traditionally slow tasks. It reduces manual input, handles multiple documents at once, and integrates directly with backend systems, cutting onboarding from days and weeks to hours and minutes, with improved accuracy and customer satisfaction.

Additional Resources

Egnyte Launches Secure Document Portal for Financial Services

Egnyte introduces a tailored Document Portal for financial firms, offering secure collection, sharing, and AI-powered validation ...

Automate Smarter With Egnyte AI Agents

Use AI-driven agents within Egnyte to trigger workflows, enforce policy, and extract insights — all without manual ...

Egnyte for Financial Services

Leverage Egnyte’s secure content cloud for financial firms — compliant file sharing, AI insights, and automated ...